This is part of my Prime Day blog post series. Even though Prime Day 2025 is done, these posts apply to all online shopping. It is my mission to expose the online shopping aggregators and how they make you spend more money for things you don’t need.

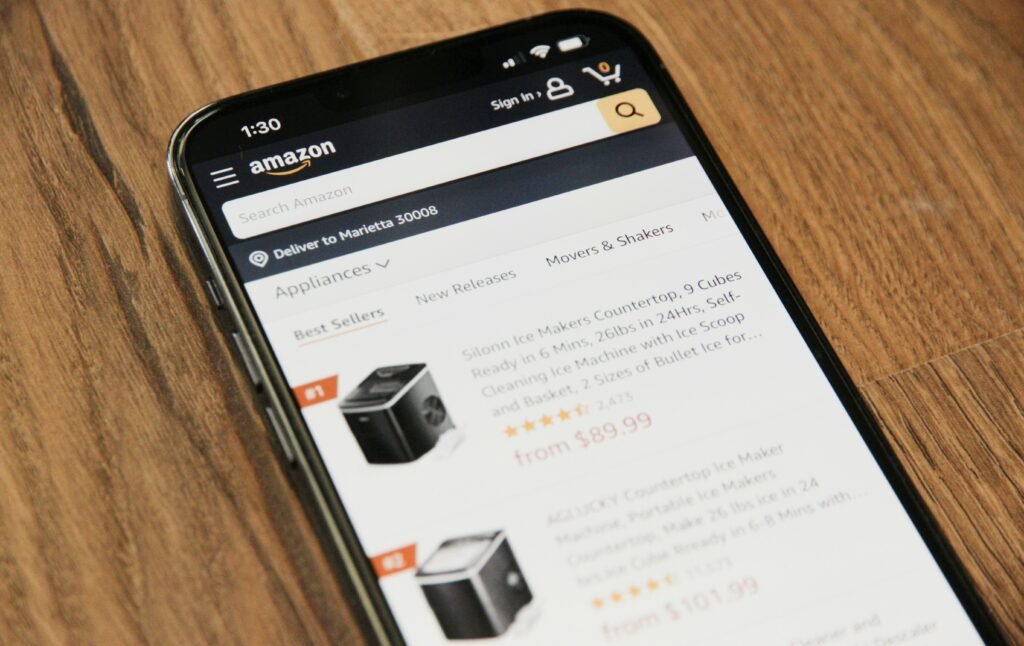

I hope you have turned off notifications from your phone’s Amazon app. Because if not:

Your phone buzzes: "Flash sale ends in 10 minutes!" Your heart rate quickens slightly. You weren't even thinking about shopping, but suddenly you're scrolling through products, adding items to your cart, and completing a purchase you hadn't planned. Sound familiar? Your wallet just got lighter, and you're not alone in this experience.

This scenario plays out millions of times daily across India, where online shopping has transformed from a convenience into something far more complex. Understanding how these apps are designed to capture your attention and trigger purchases is the first step toward regaining control over your digital shopping habits.

The Psychology Behind App Design: Why Your Brain Says “Buy Now”

Think of your favorite shopping app (not just Amazon) as a carefully crafted psychological experiment, where you’re both the subject and the target. These platforms don’t just sell products; they sell emotions, urgency, and the promise of instant gratification. To understand how this works, we need to examine the fundamental principles of behavioral psychology that app designers employ.

The human brain is wired to respond to certain visual and emotional triggers that shopping apps exploit with surgical precision. Consider the color red, which appears in almost every “limited time” offer you encounter. This isn’t a coincidence. Red triggers a physiological response that increases heart rate and creates a sense of urgency. When you see a red countdown timer showing “Only 2 hours left,” or “limited time deal”, your brain interprets this as a threat to missing out, activating your fight-or-flight response. Advanced FOMO, basically.

Similarly, the endless scroll feature copies the same psychological mechanism found in gambling. Each swipe reveals new products, creating what psychologists call “variable reward schedules.” Your brain releases small amounts of dopamine with each new discovery, much like a slot machine player experiences with each pull of the lever. This creates a powerful feedback loop that keeps you engaged far longer than you intended.

The placement of product recommendations follows another psychological principle called “social proof.” When you see “People who bought this also bought…” or “4.5 stars from 10,000 reviews,” your brain assumes that if many others have made this choice, it must be the right one. This bypasses your rational decision-making process and appeals directly to your tribal instincts.

The Technology Behind the Temptation: Algorithms That Know You Better Than You Know Yourself

Modern shopping apps employ sophisticated algorithms that analyze your behavior patterns to predict and influence your purchasing decisions. These systems work by collecting vast amounts of data about your browsing habits, purchase history, and even the time you spend looking at specific products.

Machine learning algorithms process this information to create detailed psychological profiles. They know that you tend to shop for electronics on Sunday evenings, that you’re more likely to buy skincare products after viewing fashion items, and that you typically abandon your cart but return to complete purchases when offered a small discount. This level of personalization makes every interaction feel tailored specifically for you, increasing the likelihood of conversion.

Push notifications represent perhaps the most direct manipulation technique. These alerts are timed based on your historical activity patterns and psychological vulnerability windows. The app might send you a notification about a sale just as you’re settling in for the evening, when your decision-making defenses are naturally lower. The timing isn’t random; it’s calculated to maximize your likelihood of engaging. Please, please disable notifications from your shopping apps.

The recommendation engine works by analyzing patterns across millions of users with similar profiles. If users who share your demographic and shopping patterns frequently purchase certain items together, the algorithm will suggest these combinations to you. This creates an artificial sense of need for products you might never have considered otherwise.

The Indian Context: Festival Sales and Social Shopping Pressure

India’s unique cultural and social dynamics create additional layers of complexity in the online shopping ecosystem. The festival season, which typically spans from August to November, has become synonymous with massive online sales events. Diwali, Dussehra, and other celebrations are now as much about shopping as they are about tradition and family.

This cultural integration of shopping with celebration creates what psychologists call “justified consumption.” When a sale is tied to a festival, the purchase feels culturally appropriate and necessary rather than impulsive. Apps capitalize on this by creating elaborate festival-themed campaigns that make shopping feel like participation in cultural tradition rather than mere consumption.

The concept of “social shopping” has gained particular traction in India, where family and peer opinions heavily influence purchasing decisions. Features like “Share with friends” or “Get opinions from your network” tap into the collectivist nature of Indian society. When friends and family can see and comment on your potential purchases, the social pressure to buy increases significantly.

Regional pricing and vernacular language support create additional psychological comfort. When you see prices in your local language and currency, with payment options familiar to your region, the cognitive barriers to purchase decrease. The app feels less like a foreign platform and more like a local marketplace you can trust.

The Real Impact: When Convenience Becomes Compulsion

The consequences of this sophisticated psychological manipulation extend far beyond individual spending decisions. Across India, stories emerge of people accumulating debt, experiencing anxiety, and developing genuine shopping addictions due to their relationship with online shopping apps.

Consider the case of Priya, a software engineer from Bangalore, who found herself spending nearly 40% of her monthly income on online purchases. What started as convenient shopping for essentials gradually escalated into daily browsing sessions and impulse purchases. The easy one-click payment options, combined with credit and Amazon’s pay later schemes, created a dangerous disconnect between spending and the immediate impact on her finances.

The psychological toll manifests in various ways. Many users report feelings of guilt and shame after making unplanned purchases, followed by anxiety about their financial situation. This creates a cycle where shopping becomes both the source of stress and the temporary escape from that stress. The instant gratification of receiving packages provides a brief mood boost, but the underlying issues remain unaddressed.

Credit and payment flexibility, while genuinely helpful for planned purchases, can become enablers of problematic spending. When you can split a ₹10,000 purchase into four easy payments, the financial impact feels reduced, even though the total cost remains the same. This psychological accounting error leads to accumulating multiple payment obligations that can become overwhelming.

Taking Control: Strategies for Mindful Digital Shopping

Regaining control over your digital shopping habits requires understanding both the psychological mechanisms at play and practical strategies for intervention. The goal isn’t to eliminate online shopping entirely, but to transform it from an impulsive activity into a mindful, intentional practice.

Start by recognizing your personal vulnerability patterns. Most people have specific times, moods, or situations when they’re more susceptible to impulse purchases. You might notice that you shop more when you’re stressed, bored, or feeling lonely. Some people are more vulnerable late at night when their decision-making faculties are naturally diminished. By identifying these patterns, you can create targeted strategies for these high-risk moments.

Create physical and digital barriers between impulse and action. Remove shopping apps from your phone’s home screen, requiring you to search for them each time. This small friction can be enough to break the automatic response of opening the app when you’re bored. Log out of your accounts after each session, making the next purchase require deliberate effort to log back in.

Implement a “cooling-off” period for all non-essential purchases. When you feel the urge to buy something, add it to your wishlist instead and wait 24 hours for smaller items or a week for larger purchases. This simple delay allows your rational mind to evaluate whether the purchase aligns with your actual needs and budget. I typically add such items to my cart and leave it there for two weeks.

Budgeting apps – use technology to fight technology. Several apps and browser extensions can help you monitor and control your spending. Apps like “Mint” or “YNAB” (You Need A Budget) (not sponsored) can track your spending patterns and send alerts when you’re approaching your budget limits. Browser extensions can block shopping websites during certain hours or require additional steps before completing purchases.

Practice mindful budgeting by allocating specific amounts for different categories of spending. When you have a predetermined budget for entertainment, clothing, or gadgets, it becomes easier to evaluate whether a potential purchase fits within your financial goals. This also helps distinguish between needs and wants, a crucial skill for responsible spending.

Building Long-Term Awareness and Healthy Habits

The most sustainable approach to managing digital shopping addiction involves developing a deeper understanding of your relationship with consumption and finding alternative ways to meet the underlying needs that shopping temporarily fulfills.

Many people shop when they’re seeking entertainment, social connection, or emotional regulation. Identifying these underlying needs allows you to find healthier alternatives. If you shop when you’re bored, consider developing new hobbies or interests. If shopping provides social connection, look for community activities or social groups that offer more meaningful interaction.

Regular financial check-ins with yourself can help maintain awareness of your spending patterns. Set aside time each month to review your purchases, categorizing them as planned, useful impulse buys, or regrettable purchases. This practice helps you recognize patterns and make more informed decisions in the future.

Consider the environmental and social impact of your consumption choices. Understanding the broader consequences of fast fashion, excessive packaging, and consumer culture can provide additional motivation for more mindful shopping. When you view each purchase through the lens of its broader impact, the decision-making process naturally becomes more thoughtful.

Remember that developing healthier shopping habits is a gradual process that requires patience with yourself. The psychological mechanisms that drive impulse purchasing are powerful and deeply ingrained. Progress often comes in small steps rather than dramatic changes. Celebrate small victories, like successfully waiting 24 hours before making a purchase or staying within your monthly budget, as these build the foundation for lasting change.

The goal isn’t to become someone who never enjoys shopping or never makes spontaneous purchases. Instead, it’s to become someone who shops with intention, awareness, and alignment with your values and financial goals. By understanding how these apps are designed to influence your behavior, you can make more conscious choices about when and how you engage with them, ultimately creating a healthier relationship with digital consumption.

[…] Here’s something I have said before: You’re not the customer, you’re the product. I even made a short video about it and have written many posts about it, like this one. […]