I have been saying for sometime – it is semiconductors, and not AI (or anything else for that matter), that will propel India to the foremost Tech provider (of sorts) in the world. This is the most detailed explanation on why – from the history of semiconductors to its current state and why the future looks bright for India in this space.

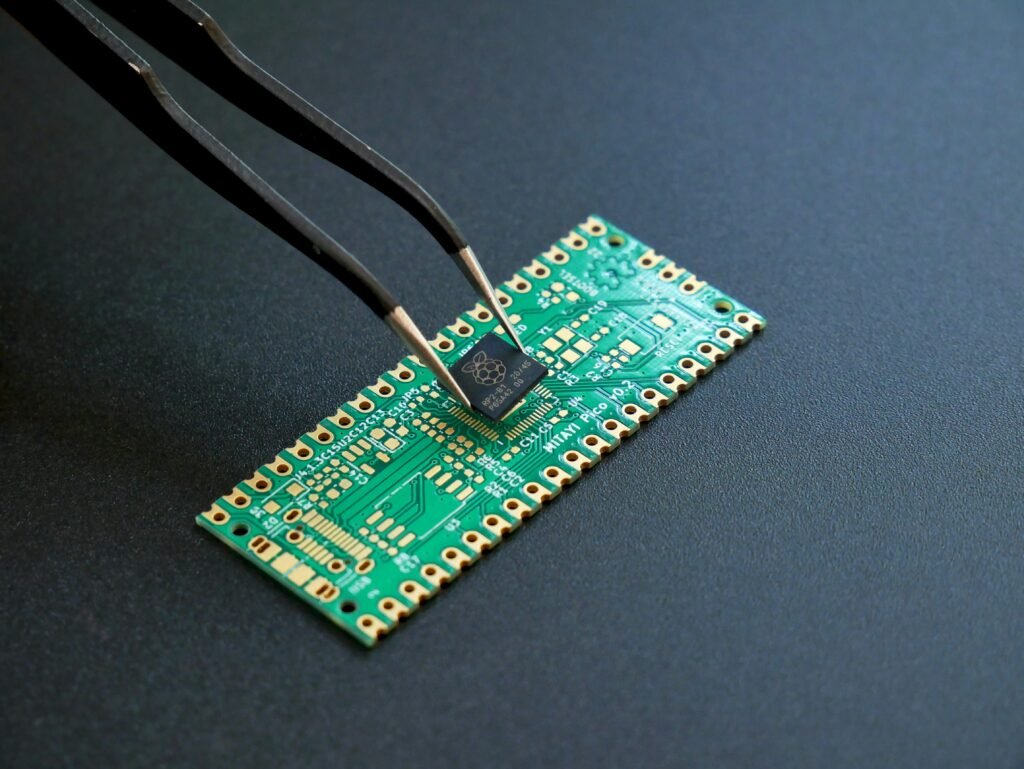

In today’s digital world, semiconductors form the backbone of modern computing. For those of us in India’s rapidly growing tech ecosystem, understanding these critical components helps us appreciate the devices we use daily. Let’s explore how these tiny electronic marvels transformed our world.

Btw, as on date of publishing this post, the 2025 “Trump Tariff” saga seems to have reached its peak. With these so-called reciprocal tariffs taking effect a few days back, to Trump himself announcing a 90-day pause on these new tariffs for all except China, to semiconductors being exempt from these tariffs, and then threats that these semiconductors will be subject to tariffs, to the point where no one is taking any of this seriously because the Trump administration seems to change their mind every day.

Anyway, I have wanted to write this long-ish post on semiconductors for a long time, as I have believed for a long time that India has the potential to even outrun Taiwan in terms of semiconductor production and supply the world over, and I have put a lot of work (including heart and soul (and kidney)) into this article. Hope you enjoy reading this as much as I enjoyed writing it!

What Are Semiconductors and Why Are They Essential?

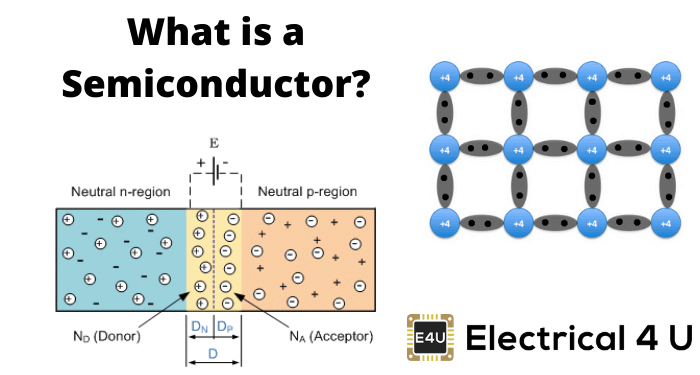

At their core, semiconductors are materials with electrical conductivity between that of a conductor and an insulator. This unique property allows them to be manipulated to control electrical current flow, making them perfect for processing the binary language of 1s and 0s that computers use.

Silicon is the most commonly used semiconductor material due to its abundance (it makes up about 28% of the Earth’s crust) and stability. Other semiconductor materials include germanium, gallium arsenide, silicon carbide, and gallium nitride, each with specific applications based on their unique properties.

Technical Note: Semiconductors achieve their special properties through “doping” – the process of intentionally introducing impurities into an extremely pure semiconductor material. N-type semiconductors (doped with elements like phosphorus) have extra electrons, while P-type semiconductors (doped with elements like boron) have “holes” or electron deficiencies. The junction between these types creates the crucial P-N junction that enables electronic components to function.

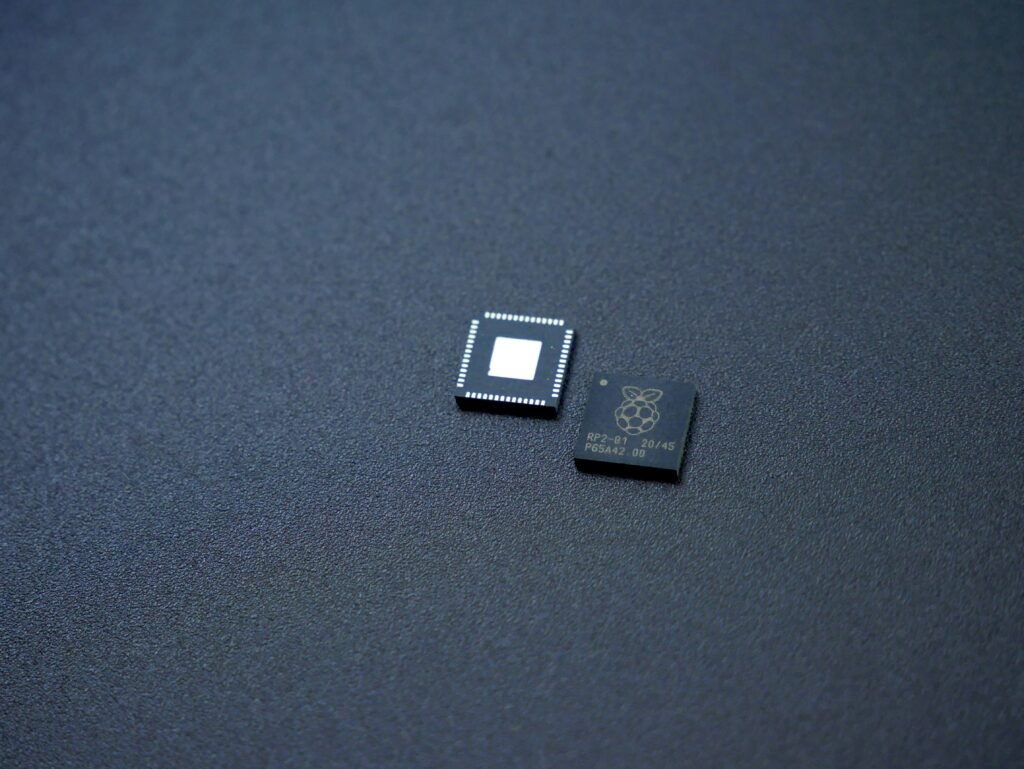

The most important semiconductor device is the transistor – essentially an electronic switch that can amplify signals and perform logic operations. These transistors are the fundamental building blocks of all computing devices, from your smartphone to supercomputers.

Without semiconductors, we simply wouldn’t have:

- Computers and smartphones

- Internet connectivity

- Digital appliances

- Modern vehicles

- Medical diagnostic equipment

- And countless other gadgets and technologies we rely on daily.

The Birth of an Industry: Early History of Semiconductors

The semiconductor journey began in 1947 (had nothing to do with Indian independence) when three scientists at Bell Laboratories – William Shockley, John Bardeen, and Walter Brattain – invented the first working transistor. This breakthrough earned them the Nobel Prize in Physics in 1956, and more importantly, launched the modern electronics revolution.

Prior to transistors, computers relied on bulky vacuum tubes, making them room-sized machines that consumed enormous power and frequently failed. The transistor changed everything by offering a component that was:

- Much smaller

- More reliable

- Energy efficient

- Less heat-generating

- Cheaper to manufacture at scale.

In 1958, Jack Kilby of Texas Instruments developed the first integrated circuit (IC), placing multiple transistors on a single silicon chip. Shortly after, Robert Noyce of Fairchild Semiconductor created a more practical version using silicon. These innovations set the stage for Moore’s Law, named after Intel co-founder Gordon Moore, who observed in 1965 that the number of transistors on a chip would double approximately every two years.

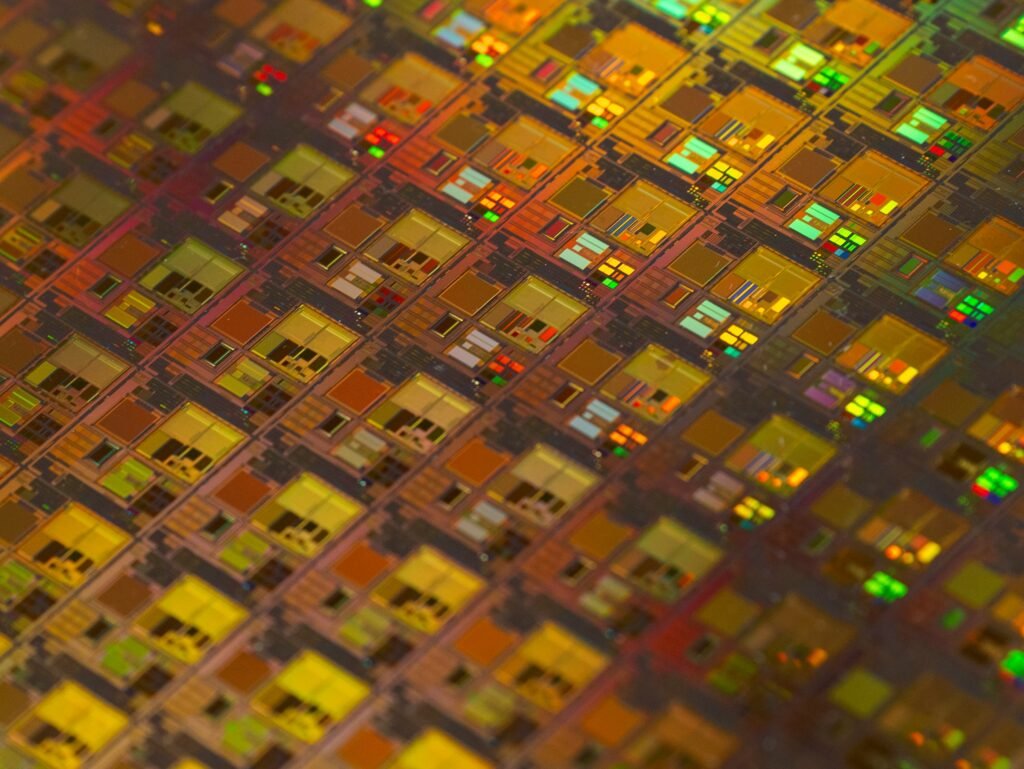

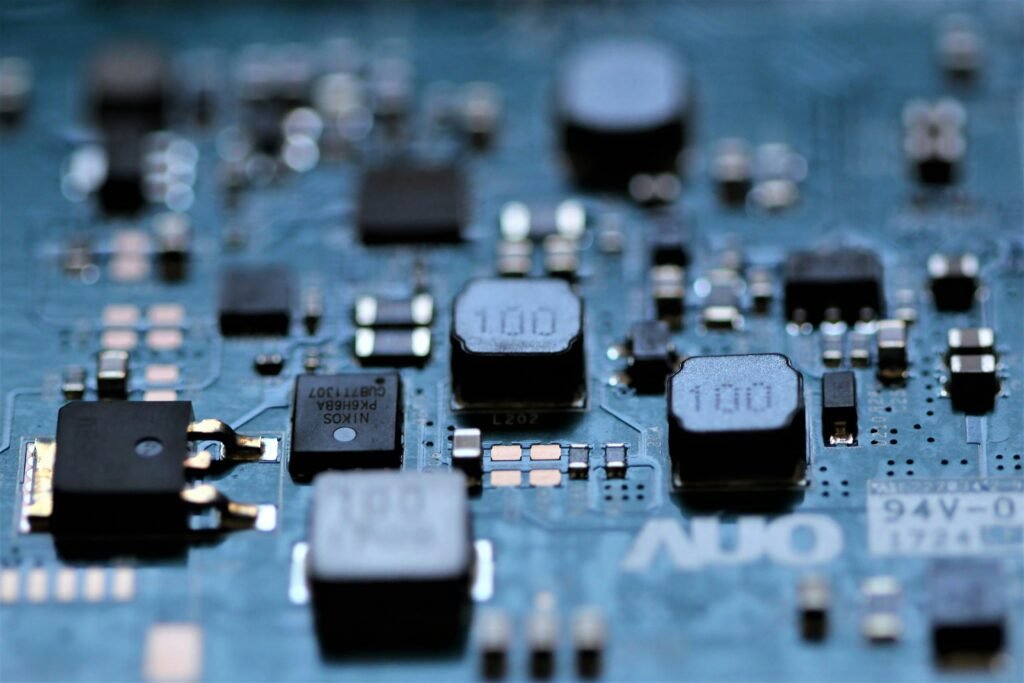

Technical Note: Modern semiconductor manufacturing uses a process called photolithography to create transistors. This involves projecting patterns onto silicon wafers coated with photoresist material, followed by etching and deposition steps. Today’s most advanced processes use Extreme Ultraviolet (EUV) lithography, which works at a wavelength of 13.5 nanometers to create transistors measured in single-digit nanometers – thousands of times smaller than a human hair.

The Computer Revolution: Semiconductors as the Engine of Change

The impact of semiconductor advancement on computing cannot be overstated. Consider these milestones:

1971: Intel introduced the 4004, the first commercially available microprocessor with 2,300 transistors.

1981: The IBM Personal Computer launched, bringing computing power to businesses and homes.

1990s: The Internet began transforming daily life, powered by increasingly powerful semiconductor technology.

2007: The smartphone era began in earnest with Apple’s iPhone (let’s face it – Blackberry didn’t really bring on the smartphone revolution), integrating powerful computing capabilities into a pocket-sized device.

Today: Modern chips contain billions of transistors, with Taiwan Semiconductor Manufacturing Company (TSMC)’s most advanced processes packing over 100 million transistors per square millimeter.

The statistics tell a compelling story. From 1990 to 2021, global semiconductor sales grew from approximately $50 billion to over $555 billion, representing more than a 1000% increase. This growth mirrors the exponential increase in computing power and the expanding role of technology in our lives.

India’s Semiconductor Journey

India’s relationship with semiconductors has evolved significantly over the decades:

Early Days

- In the 1980s, the Semiconductor Complex Limited (SCL) was established in Mohali as India’s first semiconductor fabrication unit

- The Centre for Development of Advanced Computing (C-DAC) was founded in 1988 to develop supercomputing technologies.

Growing Expertise

- India emerged as a global hub for semiconductor design, with nearly every major global semiconductor company establishing design centers in cities like Bangalore, Hyderabad, and Pune

- By 2023, India had over 2,000 semiconductor design firms employing more than 120,000 engineers

- Indian expertise in VLSI (Very Large Scale Integration) design has become particularly recognized globally.

Recent Developments

- The India Semiconductor Mission (ISM) launched in December 2021 with ₹76,000 crore ($10 billion) in incentives

- In 2023, Micron Technology announced a $2.75 billion semiconductor assembly and test facility in Gujarat

- Tata Group has announced plans to build a semiconductor fabrication plant in Dholera, Gujarat (expected to complete in phases over 2026-27)

- The SEMICON India 2023 conference in Gandhinagar highlighted the country’s ambitions to become a global semiconductor hub.

Educational Initiatives

- The C-MET (Centre for Materials for Electronics Technology) has been working on developing essential materials for electronics manufacturing

- IIT Madras has established the IITM Research Park which includes semiconductor research facilities

- The India Semiconductor Research Center was proposed in the 2023 budget to boost advanced research capabilities.

Technical Note: India’s semiconductor strategy focuses on several distinct segments of the value chain: compound semiconductors, silicon photonics, sensors, discrete semiconductors, and memory chips. The country’s strengths in chip design (where logical architecture is created using Hardware Description Languages like VHDL and Verilog) provide a foundation for expanding into manufacturing.

The Global Semiconductor Industry: From Silicon Valley to Taiwan’s Dominance, drawing parallels

The semiconductor industry’s early days were dominated by American companies like Fairchild Semiconductor, Texas Instruments, and Intel. Silicon Valley earned its name from the silicon used in semiconductor manufacturing.

Today, the industry has evolved into a complex global ecosystem with several key players:

- Design: Companies like Qualcomm, NVIDIA, AMD, and Apple design chips but often don’t manufacture them

- Manufacturing: Dominated by “foundries” that produce chips designed by others

- Equipment: Companies like ASML that make the sophisticated machinery used to produce chips.

Taiwan’s Rise to Semiconductor Manufacturing Dominance

Taiwan Semiconductor Manufacturing Company (TSMC) has emerged as the world’s largest contract chipmaker, producing approximately 90% of the world’s most advanced semiconductors. Founded in 1987, TSMC pioneered the “foundry” business model, focusing exclusively on manufacturing chips designed by other companies.

TSMC’s dominance stems from its technological leadership, massive scale, and ability to produce the most advanced chips at high volumes. As of 2023, TSMC held approximately 56% of the global foundry market share.

Technical Note: TSMC’s technological edge comes from its mastery of advanced process nodes. Their N3 (3 nanometer) process uses Gate-All-Around (GAA) transistor architecture, a significant improvement over previous FinFET designs. These transistor structures enhance electrostatic control, allowing for greater performance in smaller areas while reducing power consumption – critical factors as we approach the physical limits of Moore’s Law.

Other major semiconductor manufacturers include:

- Samsung (South Korea): The second-largest foundry, with about 18% market share

- Intel (USA): Primarily manufactures its own designs but is expanding foundry services

- UMC (Taiwan): Specializes in less advanced manufacturing processes

- GlobalFoundries (USA): The fourth-largest foundry globally.

The Global Semiconductor Shortages: When Supply Chains Failed Especially in 2020-22

The world experienced a severe semiconductor shortage beginning in 2020 that extended well into 2022. This crisis revealed just how dependent global industries had become on a steady flow of semiconductor components.

Several factors contributed to this shortage:

- COVID-19 pandemic: Factory shutdowns and work restrictions disrupted production

- Surge in demand: Remote work and education dramatically increased demand for computers and electronics

- Automotive industry miscalculation: Many car manufacturers canceled chip orders early in the pandemic, then struggled to regain supply when demand returned

- Limited production capacity: Building new semiconductor factories takes years and billions in investment

- Geopolitical tensions: Particularly between the US and China complicated global supply chains

The impact was severe across multiple industries:

- Automotive: Production of an estimated 7.7 million vehicles was delayed in 2021, costing the industry approximately $210 billion in revenue

- Consumer electronics: Sony’s PlayStation 5 and Microsoft’s Xbox Series X faced severe shortages for nearly two years

- Smartphone industry: Experienced delayed product launches and limited availability

- Healthcare equipment: Medical device manufacturers faced component shortages for critical equipment

Impact on India

The semiconductor shortage had significant consequences for India’s growing technology ecosystem:

- Automotive Industry: Indian automakers reported over ₹10,000 crore in lost sales during 2021-22. Maruti Suzuki alone had a backlog of over 240,000 orders in early 2022 due to chip shortages.

- Smartphone Market: India’s smartphone shipments declined by nearly 8% in 2021 compared to pre-pandemic levels, primarily due to supply constraints. Companies like Xiaomi, Realme, and Samsung had to delay several product launches.

- Price Inflation: According to the India Electronics and Semiconductor Association (IESA), electronic products saw price increases of 10-25% across various categories during the shortage period.

- Policy Response: The shortage accelerated India’s push toward semiconductor self-reliance, with the government increasing the Production Linked Incentive (PLI) scheme for electronics manufacturing to ₹2.3 lakh crore.

- Digital India Initiative: Several key Digital India projects faced delays as equipment procurement was affected by the global component shortage.

Major Investments by Region Into Capacity Expansion in 2025

As on date of this post, the below are noteworthy capital investments by region into setting up or expanding foundries.

United States

- TSMC: TSMC is investing $40 billion to build two semiconductor facilities in Phoenix, Arizona. The second facility, set to open in 2026, will produce advanced 3-nanometer chips. This is one of the largest foreign direct investments in U.S. history and aligns with the U.S. CHIPS and Science Act (yes, the US has an Act / Law about Chips).

- Intel: Intel is investing over $32 billion in constructing two new chip factories and modernizing an existing fab in the U.S., focusing on advanced semiconductor technologies.

- SK Hynix: The South Korean company plans to invest $15 billion in a new advanced chip packaging facility, creating approximately 1,000 jobs.

India

- Tata Electronics: Tata is investing over ₹910 billion (approximately $10.44 billion) to establish a semiconductor fabrication plant in Gujarat. The facility will cater to AI, automotive, and high-performance computing markets.

- Vedanta-Foxconn JV: This partnership is investing $18 billion to build a semiconductor fab and display manufacturing unit in Gujarat. The fab will operate on 28-nanometer technology nodes.

Taiwan

- TSMC: TSMC continues to expand with multiple projects, including three wafer fabs and two chip packaging plants domestically. Additionally, it has overseas projects such as a €5 billion FinFET-capable foundry in Dresden, Germany.

- UMC: United Microelectronics Corporation focuses on expanding its global IC fabrication services with significant investments across its facilities.

South Korea

- Samsung: Samsung has committed ₩171 trillion (approximately $150 billion) through 2030 for its System LSI and Foundry businesses. This includes constructing a new production line in Pyeongtaek for advanced semiconductors using EUV lithography technology.

Europe

- TSMC-led ESMC: In partnership with Bosch, Infineon, and NXP, TSMC is establishing Europe’s first FinFET-capable foundry in Dresden, Germany, with €5 billion in state aid from the EU Commission.

- Intel’s European Expansion: Intel has committed substantial investments across Europe to bolster its semiconductor manufacturing capabilities under the EU Chips Act framework.

China

- SMIC (Semiconductor Manufacturing International Corporation): SMIC continues to expand as China’s largest foundry, focusing on advanced nodes like 14 nm and FinFET technologies. Its revenue grew significantly due to increased demand for domestic chip production.

Key Trends Driving Investments

- Government Incentives: Programs like the U.S. CHIPS Act and European Chips Act are spurring massive investments.

- Technological Advancements: Companies are focusing on cutting-edge technologies such as EUV lithography and advanced packaging.

- Supply Chain Resilience: Global disruptions have pushed countries to localize semiconductor production for strategic independence.

A lot of these (e.g. TSMC’s setup in the USA) are indeed politically motivated, and I can’t include all the politics about them here but if you’d like me to elaborate on any of them (with the TSMC-USA one being the most fascinating IMO) let me know!

The Future of Semiconductors: Projected Demand and Significance

The semiconductor industry is projected to grow substantially in the coming decade:

- The global semiconductor market is forecast to reach $1 trillion by 2030, up from approximately $555 billion in 2021

- AI-related chip demand is expected to grow at a compound annual growth rate (CAGR) of over 30% through 2030

- Automotive semiconductor demand is projected to triple by 2030 as electric vehicles and autonomous driving technologies proliferate

- IoT device proliferation will drive demand for specialized, low-power semiconductors with projected shipments of 75 billion IoT-connected devices by 2030

Technical Note: The future of semiconductors will increasingly involve heterogeneous integration – combining different types of chips and components in advanced packages. Technologies like chiplets (small, specialized dies), 3D stacking, and through-silicon vias (TSVs) allow systems to overcome the limitations of monolithic integration while optimizing performance, power, and manufacturing yields.

India’s Semiconductor Future

India’s semiconductor ambitions show significant promise:

- The semiconductor component market in India is projected to reach $300 billion by 2026

- By 2030, India aims to establish at least 2-3 high-end semiconductor fabs and 10 design companies valued at over $1 billion each

- The Electronic System Design and Manufacturing (ESDM) sector in India is expected to expand from $76 billion in 2021 to $300 billion by 2026

- India’s semiconductor design industry is projected to employ over 250,000 engineers by 2030

- The India Semiconductor Mission targets 85,000+ highly qualified engineers through special training programs by 2029

Important initiatives supporting this growth include:

- Design Linked Incentive (DLI): Providing financial incentives for semiconductor design startups

- Chip to Startup (C2S) Program: Aimed at training 85,000 engineers in specialized semiconductor skills

- Semi-Conductor Laboratory (SCL): Being modernized with private sector partnerships

- Indian Semiconductor Mission: Serving as a specialized business division within the Digital India Corporation.

Several trends will shape the industry’s future:

- Artificial Intelligence: Specialized AI processors and accelerators will see explosive growth (though I still maintain that the AI bubble will burst (globally) in 2025)

- Quantum Computing: Though early-stage, quantum technologies may eventually complement traditional semiconductors for specific applications

- Regional Diversification: Countries including the US, EU, Japan, and India are investing heavily to reduce dependence on Taiwan and create more resilient supply chains

- Advanced Packaging: As traditional scaling becomes more challenging, new packaging technologies will allow for continued performance improvements

- Sustainable Manufacturing: Energy-efficient production methods will become increasingly important as the industry grows.

Conclusion: A Chip Off the Old Block

Ok sorry for the pun.

From their humble beginnings in the mid-20th century, semiconductors have become the foundation of our digital world. Their evolution continues to accelerate technological progress across every sector of the global economy.

For India’s tech ecosystem, the semiconductor industry represents both a challenge and an enormous opportunity. While we’ve established strength in chip design, building a complete semiconductor ecosystem including manufacturing will require sustained investment, policy support, and industry collaboration.

As India works toward technological self-reliance through the Atmanirbhar Bharat initiative, semiconductors will play a crucial role. The investments being made today in facilities, education, and research could transform India into a significant player in the global semiconductor landscape within the next decade.

The next few years will be pivotal for India’s semiconductor ambitions. Those who stay informed about these developments will be better positioned to navigate the rapidly evolving tech landscape.

Stay Informed with Tech India and me as I continue to bring you insights into the technologies shaping our future. If you enjoyed this please share with three friends and one person you don’t like also. 🫶🏼